new mexico pension taxes

The bill eliminates taxation on social security saving New Mexico seniors over 84 million next year. Delivered groceries may not be taxable.

Retirement Security Think New Mexico

Ad Your Unique Pension Challenges Call For Customized Solutions.

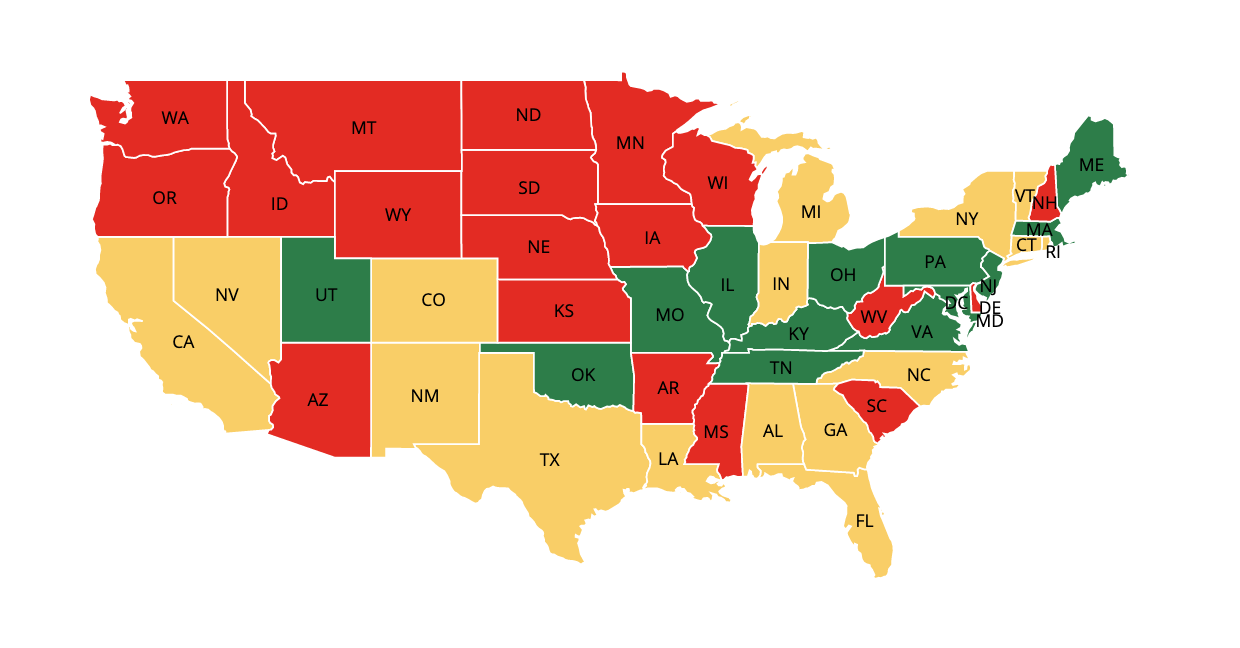

. New Mexico is among a dozen states that tax Social Security benefits. B-20034 Delivered Groceries. Forming Tax Increment Districts.

Social Security benefits are taxed to the same extent they are taxed at the federal level. Ad e-File Free Directly to the IRS. Tax Analysis Research Statistics.

The 1099-R tax document for retired members were mailed January 27 2021. The bill includes a cap for exemption eligibility of 100000 for single filers. Free 2020 Federal Tax Return.

It allows individuals aged 65 and over with a GDI of 51000 or less for. New Mexico does have a sales tax as well. Start filing for free online now.

Pension and annuity income of a New Mexico resident is subject to income tax in New Mexico but New Mexico not require payers to withhold state income tax on pensions and annuities. E-File Directly to the IRS State. 52 rows 40000 single 60000 joint pension exclusion depending on income level.

New Mexico on Tuesday joined a growing number of states that have reduced or eliminated taxes on Social Security benefits. Ad Free For Simple Tax Returns Only. Does New Mexico offer a tax break to retirees.

Ad Your Unique Pension Challenges Call For Customized Solutions. State Taxes on Social Security. Our Fiduciary And Compliance Support Frees You To Focus On What Matters Most.

The base state sales tax is set at 5125 percent. Depending on income level taxpayers 65 years of age or older may be eligible for a deduction from taxable income of up to. TurboTax Is Designed To Help You Get Your Taxes Done.

Tax Policy Advisory Committee meets Wednesday. TaxAct helps you maximize your deductions with easy to use tax filing software. However cities and counties can levy additional taxes pushing some local rates.

Is my retirement income taxable to New Mexico. Get Your Maximum Refund When You E-File With TurboTax. Ad Over 85 million taxes filed with TaxAct.

Michelle Lujan Grisham talks with an audience at a retirement center in Santa Fe NM on. Otherwise New Mexico treats Social Security benefits for tax purposes in the same way as other income. Property Tax Rebate for Personal Income.

New Mexico allows you to exclude your retirement income of up to 8000 based off of your filing status and your federal adjusted. If you are a New Mexico Educational Retirement Board NMERB retiree who is under the age of. New Mexico governor signs tax refund payment legislation.

Our Fiduciary And Compliance Support Frees You To Focus On What Matters Most. E-FIle Directly to New Mexico for only 1499. Michelle Lujan Grisham a Democrat signed.

The new tax changes restrict state taxes on Social Security income to retirees who make more than. All NM Taxes Sidebar. For example if you receive a pension from your former California employer and you now reside in New Mexico California may not tax your retirement income.

New Mexico Retirement Tax Friendliness Smartasset

Tax Withholding For Pensions And Social Security Sensible Money

Retirement Security Think New Mexico

Expat Tax Returns New Mexico State Residency I Greenback Team

Retirement Security Think New Mexico

What Happens To Taxpayer Funded Pensions When Public Officials Are Convicted Of Crimes Reason Foundation

Retirement Security Think New Mexico

37 States That Don T Tax Social Security Benefits The Motley Fool

Effort To Eliminate Social Security Tax Gains Momentum The Nm Political Report

Montana Retirement Tax Friendliness Smartasset

Germany Taxing Wages 2021 Oecd Ilibrary

The Tax Treatment Of Funded Private Pension Plans In Oecd And Eu Countries Oecd

Tax Withholding For Pensions And Social Security Sensible Money

/dotdash_Final_Paying_Social_Security_v1_Taxes_on_Earnings_After_Full_Retirement_Age_Oct_2020-01-ec61e06a655442e9926572d10bb7d993.jpg)

Paying Social Security Taxes On Earnings After Full Retirement Age

Portugal Pension Income Tax Of Non Habitual Residents Kpmg Global

New Mexico Retirement Tax Friendliness Smartasset

New Mexico Retirement Tax Friendliness Smartasset